Welcome to our website darasahuru.co.tz, in this article you will find Topic 6: Elementary Trading Profit And Loss Account - Book Keeping Form One Notes, Form One Notes All topics, Download PDF Notes Free, Book Keeping Form One Notes, Elementary Trading Profit And Loss Account PDF, Elementary Trading Profit And Loss Account Notes.

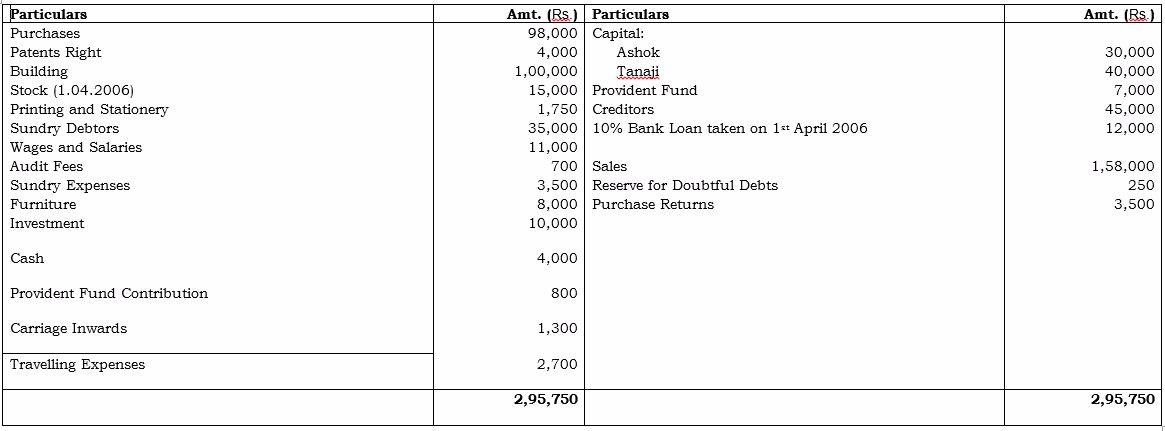

Final accounts give a concise idea about the profitability and financial position of a business to its management, owners, and other interested parties. All business transactions are first recorded in a journal. They are then transferred to a ledger and balanced.

These final tallies are prepared for a specific period. The final accounts consist of trading account, profit and loss account, and balance sheet.

Trading, Profit and Loss Account

Trading, profit and Loss account is Trading account are those accounts prepared at the end of accounting period for the determination of gross profit or gross loss of the business.

GROSS PROFIT=SALES-COST OF GOODS SOLD

A profit and loss statement (P&L) is a financial statement that summarizes the revenues, costs and expenses incurred during a specific period of time, usually a fiscal quarter or year. These records provide information about a company’s ability –or lack thereof –to generate profit by increasing revenue, reducing costs, or both.

The P&L statement is also referred to as “statement of profit and loss”, “income statement,” “statement of operations,” “statement of financial results,” and “income and expense statement.”

NET PROFT=NET PROFIT & OTHER INCOME-TOTAL EXPENSES.

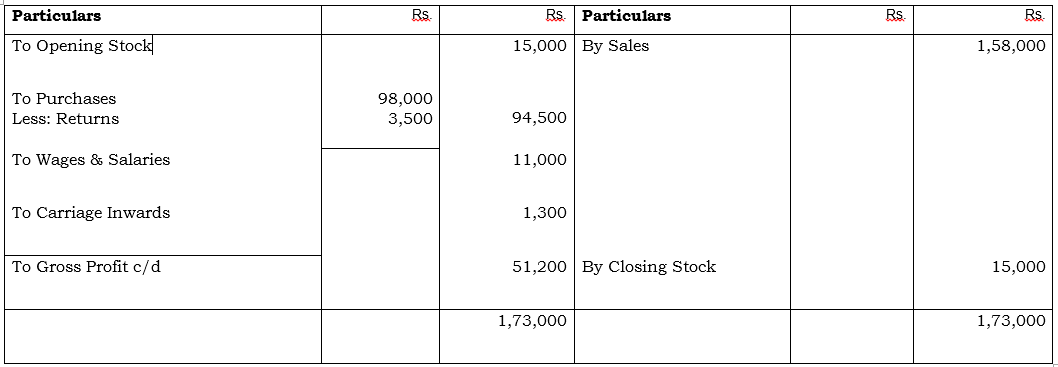

Trading Account for the year ended 31st March 2007

Gross Profit or Gross Loss

Determine the Gross profit or Gross Loss

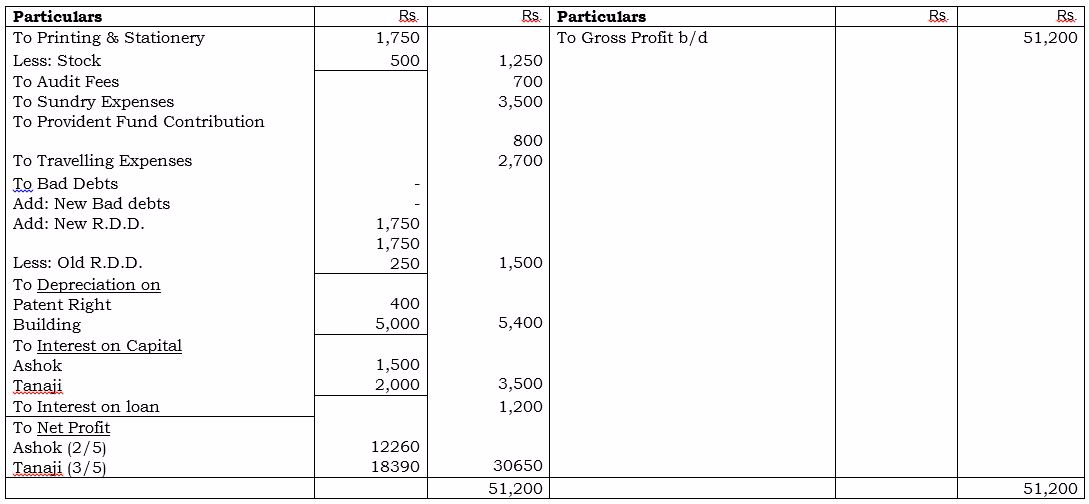

Profit & Loss A/c for the year ended 31st March 2007

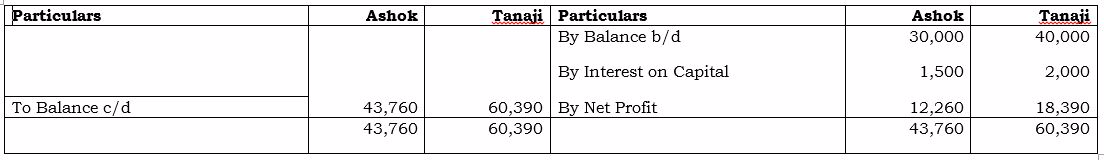

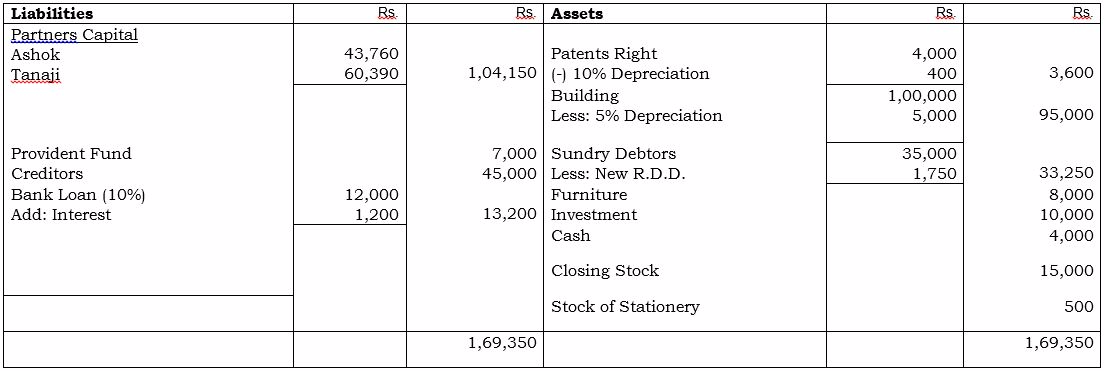

Balance Sheet as on 31-3-2007

The Cost of Goods Sold

Determine the cost of goods sold

Activity 1

Determine the cost of goods sold

The Net Profit and the Net Loss

Determine the net profit and the net loss

Activity 2

Determine the net profit and the net loss